Market Overview

South Africa’s geotextile market is segmented into woven and non-woven fabrics, with applications spanning roads, railways, dams, landfills, and coastal protection. The country’s focus on sustainable infrastructure and post-pandemic economic recovery has boosted demand.

Key Market Drivers

Infrastructure Projects: Government investments in roads, railways, and housing are primary demand drivers.

Mining Sector: Stabilization of tailings dams and erosion control in mining operations.

Environmental Regulations: Stricter laws on waste management and water conservation.

Urbanization: Expansion of cities and commercial developments.

Pricing Structure and Cost Factors

Geotextile prices in South Africa vary based on material type, weight, width, and customization. Below is a breakdown of average pricing:

Price Range (USD per Square Meter)

| Fabric Type | Weight (GSM) | Price Range | Key Applications |

|---|---|---|---|

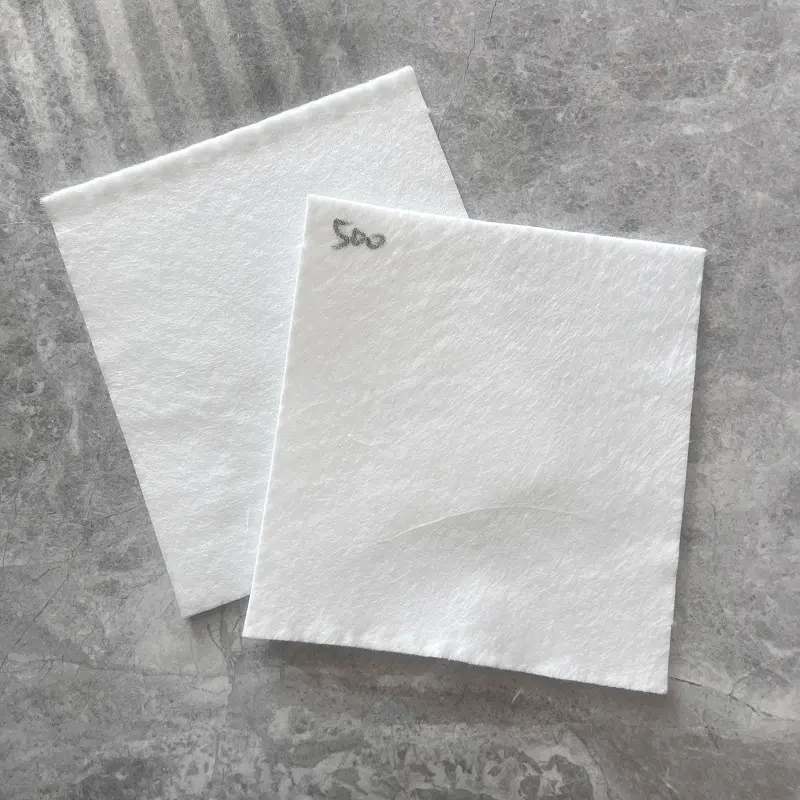

| Non-Woven Polypropylene (PP) | 100–300 | 0.50 | Road subgrade reinforcement, drainage |

| Non-Woven Polyester (PET) | 200–500 | 0.75 | Erosion control, landfill liners |

| Woven Polypropylene (PP) | 300–800 | 1.20 | High-load bearing, retaining walls |

| Heavy-Duty Composites | 800–1500 | 2.50 | Mining dams, coastal protection |

Factors Influencing Pricing

Material Costs: Polypropylene (PP) is cheaper than polyester (PET) but less UV-resistant.

Weight (GSM): Higher GSM (grams per square meter) increases durability and cost.

Customization: UV stabilization, anti-puncture coatings, or flame retardancy add 10–30% to prices.

Order Volume: Bulk purchases (10,000+ sqm) reduce costs by 15–25%.

Logistics: Imported fabrics face 10–15% higher costs due to shipping and tariffs.

Regional Price Comparison

South Africa’s geotextile prices are competitive globally but vary by region:

| Region | Average Price (USD/sqm) | Key Suppliers |

|---|---|---|

| Gauteng | 0.85 | Local manufacturers, imported fabrics |

| KwaZulu-Natal | 0.75 | Port-based distributors |

| Western Cape | 0.90 | Infrastructure-heavy demand |

| Outlying Areas | 1.10 | Higher transport costs |

Case Study: Road Construction Project

A 10 km road project in Gauteng required 50,000 sqm of non-woven PP geotextile (250 GSM). The supplier offered:

Base Price: $0.42/sqm

Discount: 20% for bulk order ($0.336/sqm)

Customization: UV coating (+15%) → Final Price: $0.386/sqm

Total Cost: $19,300

This project saved 25% compared to smaller orders, highlighting economies of scale.

Future Trends and Outlook

Sustainability Demand: Biodegradable and recycled geotextiles may gain traction.

Technology Integration: Smart geotextiles with sensors for real-time monitoring.

Local Manufacturing: Reduced reliance on imports could stabilize prices.

Government Initiatives: Infrastructure plans under the National Development Plan will sustain demand.

Conclusion

Geotextile fabric pricing in South Africa is dynamic, influenced by material type, customization, and regional demand. While non-woven PP remains the most affordable option, PET and woven fabrics dominate high-stress applications. Buyers should prioritize bulk purchases, local suppliers, and UV-resistant coatings for long-term cost savings.

As the country’s infrastructure sector expands, geotextiles will remain a cornerstone of sustainable construction, balancing cost-efficiency with environmental stewardship.

![]() 250g Filament composite geomembrane.pdf

250g Filament composite geomembrane.pdf

897.webp)

942.webp)

237.webp)